Q-Digital Platform

Meet Customer

Digitalisation helps in quick and effective interaction with customer.

Mobile Application

Mobile app helps to capture details and pre-filled application form gets generated.

Video KYC

Video KYC meeting the RBI guidelines for KYC compliance.

Automated ID Check

Automated ID check including face match feature.

OCR to Auto Capture Data

No dependency on back office for detailed data entry as OCR captures details from document images.

Pre-filled Application form

Mobile application triggers bureau check and other database verifications.

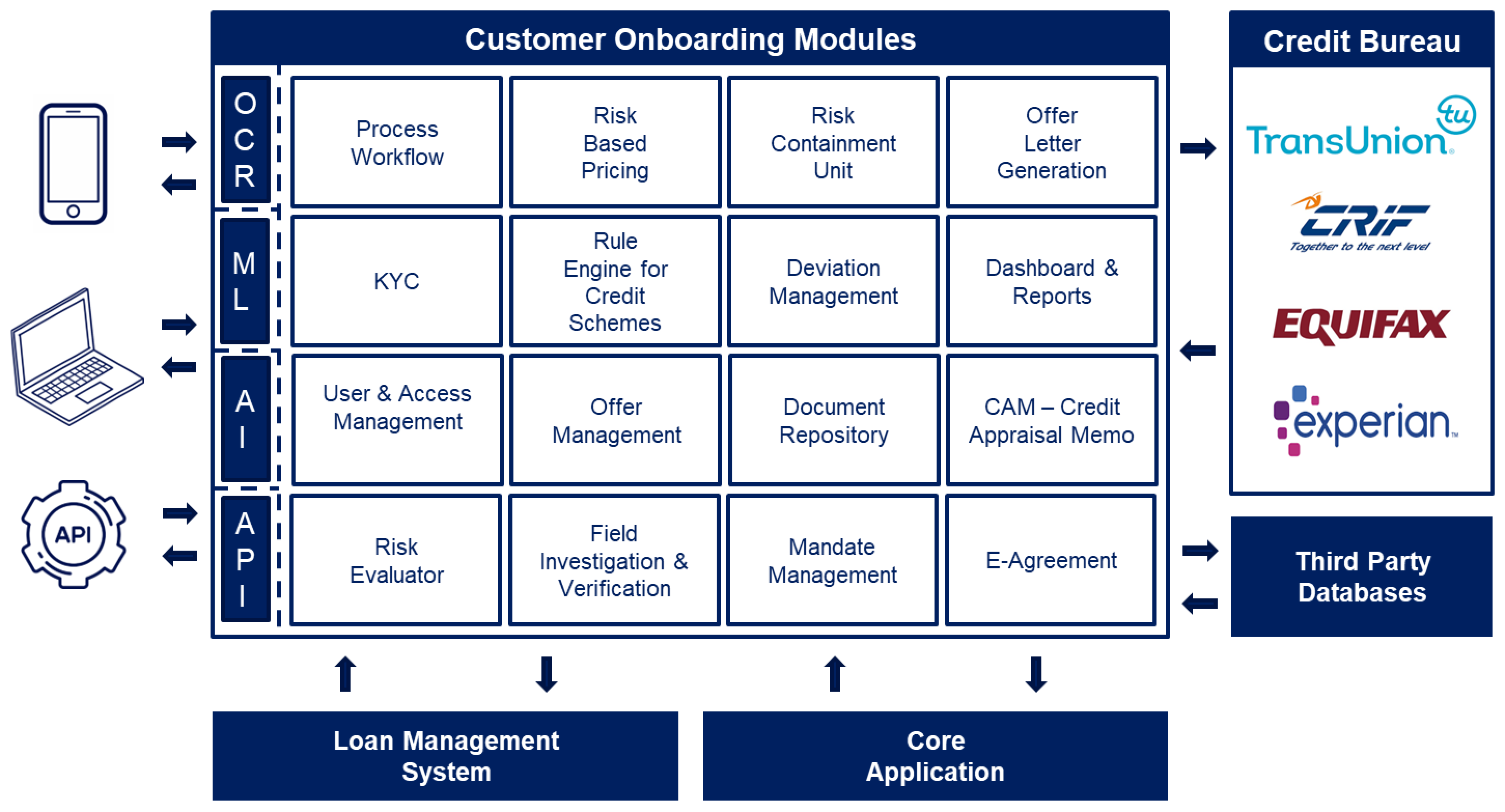

API with Data Providers

Multiple internal and external APIs, Provides data via a single point of query.

Instant Auto Allocation of Cases for FI

Rule engine auto allocate cases to most optimal verification agency

Rule based Instant Eligibility

Rule engine computes customer eligibility across all credit schemes & displays best offers on Mobile.

Customer Onboarded

Customer onboarded within few minutes.